Labor's Budget black hole just keeps expanding

Senator the Hon. Mathias Cormann

Minister for Finance

Deputy Leader of the Government in the Senate

Tonight in his Budget Reply Speech Bill Shorten must explain how his push for higher taxes is not going to hurt jobs and growth in our transitioning economy.

All Bill Shorten as a former Rudd and Gillard man seems to be offering is more unnecessary political change and higher taxes.

Tonight he must explain to the Australian people how he is proposing to pay for his many unfunded spending promises.

This comes at a time when we again received confirmation that Labor does not know how to add up, with revelations this week of a $20 billion black hole in its costings of the proposal to increase the tobacco excise.

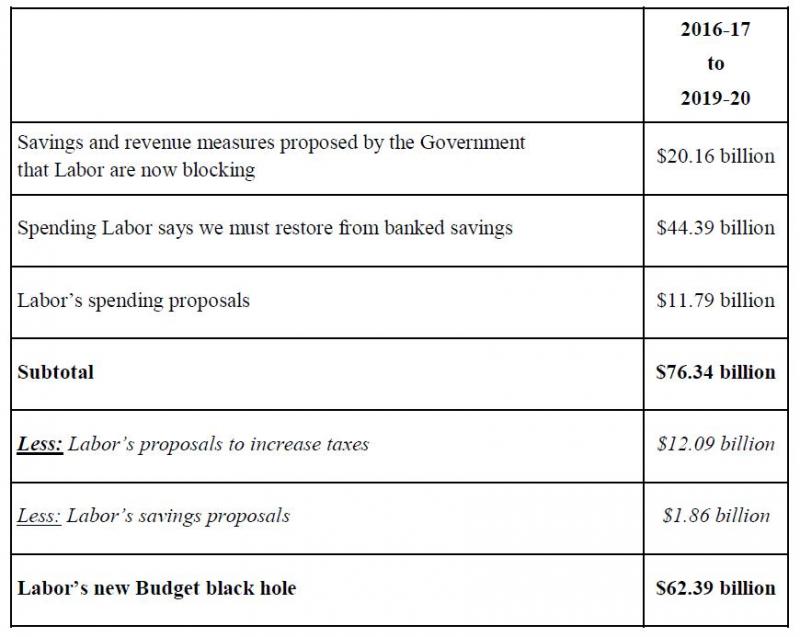

Today we can confirm that Labor's total budget black hole now stands at more than $62 billion. That is, under Labor the 2016-17 budget would be more than $62 billion worse off over the forward estimates.

This is made up of savings and revenue measures proposed by the Government which Labor are opposing, spending Labor says we must restore from banked savings and the budget impact of Labor’s own spending proposals so far.

That is why tonight Bill Shorten needs to answer these critical questions:

- Does he stand by all the spending promises he and his Shadow Ministers have made so far? If not, that is if Labor has changed its mind on any of them he needs to tell the Australian people.

- How is Bill Shorten going to pay for his unfunded spending promises?

- Is he going to pay for them with higher taxes which hurt jobs and growth?

- Is he going to pay for them with bigger deficits and debt – which will lead to higher taxes over time which hurt jobs and growth?

- Or, is he going to do what the Government has done and that is to pay for any increased spending with genuine savings, genuine spending reductions, in other parts of the Budget and if so where?

The Government on Tuesday laid out our plan for jobs and growth, including our efforts to put the budget on a sustainable foundation for the future.

Will Bill Shorten tonight again confirm his tax, spend and borrow approach which would hurt jobs and growth and undermine our economic transition from resource investment driven growth to a stronger, more innovative and diversified economy? Or will he join the Government in support of our agenda for jobs and growth and to secure our successful transition to a stronger more diversified economy?

BILL SHORTEN’S $62.39 BILLION GREAT BIG BUDGET BLACK HOLE

Savings and revenue measures put forward by Government which Labor are blocking - $20.16 billion (2016-17 to 2019-20)

1) Switching under 25s from Newstart to Youth Allowance ($639 million)

Source: Shorten and Macklin media release, 22 October 2014

2) Ceasing the Pensioner Education Supplement ($284 million)

Source: Shorten and Macklin media release, 22 October 2014

3) One week waiting period for working age payments ($256 million)

Source: Senate Standing Committee on Community Affairs Dissenting report from Labor Senators on the Social Services Legislation Amendment (Youth Employment and Other Measures) Schedule 1: Ordinary Waiting Period, 11 August 2015

4) Ceasing the Education Entry Payment ($65 million)

Source: Shorten and Macklin media release, 22 October 2014

5) Revised Higher Education Reforms ($3.27 billion)

Source: Kim Carr media release, 31 March 2015

6) Increased co-payments for subsidised pharmaceuticals ($773 million)

Source: Labor voted against this measure in the House on 16 July 2014

7) ARENA Savings ($1.03 billion)

Source: Mark Butler, Hansard, 28 August 2014

8) Abolish the Seafarer Tax Offset ($16 million)

Source: Andrew Leigh, Hansard, 17 June 2015

9) Maintain Eligibility Thresholds (indexation) ($302 million)

Source: Senate Community Affairs Legislation Committee Social Services Legislation Amendment (Youth Employment and Other Measures) Bill 2015 [Provisions] June 2015 p.24 Pause indexation for three years of income free areas

10) Better Targeting of Paid Parental Leave ($1.24 billion)

Source: Macklin media release, ‘Abbott introduces cuts to paid parental leave’ 25 June 2015 –

11) Opposing Government measure of Under 25s one month youth income support waiting period ($245 million)

Source: Macklin and O’Connor media release, 28 May 2015

12) Phase out the Family Tax Benefit end of year supplements ($6.34 billion)

Source: Shorten, Bowen and Macklin media release, 10 November 2015

13) Restructure of Family Tax Benefit Part B rates – less ceasing the FTB-B for couple families with children 13 years or over, which Labor have said they will support ($1.02 billion)

Source: Shorten, Bowen and Macklin media release, 10 November 2015

14) Changes to diagnostic imaging and pathology services bulk-billing incentives ($923 million)

Source: Catherine King media release, 16 December 2015

15) Australian Working Life Residence ($246 million)

Source: Senate Community Affairs Legislation Committee, Social Services Legislation Amendment (Fair and Sustainable Pensions) Bill 2015 [Provisions], June 2015, pp.30-31

16) New Adult and Child Public Dental Scheme ($1.30 billion)

Source: Catherine King media release, 2 May 2016

17) Abolishing the Energy Supplement ($1.33 billion)

Source: Jenny Macklin Media Release, 4 May 2016

18) Research and Development Tax Incentive — reducing the rates of the refundable and non-refundable tax offsets ($890 million)

Source: Andrew Leigh, Hansard, 17 June 2015

Spending Labor says we must restore from banked savings - $44.39 billion (2016-17 to 2019-20)

19) Restoration of Labor's preferred timetable to increase superannuation guarantee rate to 12 per cent ($6.73 billion)

Source: Shorten, interview with Patricia Karvelas: RN Drive ABC Radio: 18 March 2015- “See one way to take pressure off the Age Pension isn’t by cutting the pension, it’s by ensuring that over time, over the long run by increasing superannuation 12 per cent as Labor would do, then you’ve got people who will have less reliance on the pension.”

20) Shadow Minister for Foreign Affairs and International Development has committed Labor to spend more on foreign aid (overturning the Government’s decisions in the 2014-15 Budget and 2014-15 MYEFO) ($19.27 billion)

Source: Tanya Plibersek, ABC Radio Newcastle Interview, 30 July 2015- when asked “What would Labor do if re-elected next year?“ Plibersek: “Well we certainly wouldn’t continue with the aid cuts that are scheduled by this Government.”

21) Ceasing the funding guarantees under the National Health Reform Agreement 2011 and revising Public Hospital funding arrangements from 1 July 2017 ($4.76 billion)

Source: Chris Bowen, Sky, 26 November 2014 – “We want to see the $80 billion cut to health and education scrapped.”

22) Terminating the National Partnership on Certain Concessions for Pensioners and Seniors Card Holders ($1.37 billion)

Source: Bill Shorten, Doorstop, 4 June 2014- “We are not going to support a ruthless attack on pensioners contrary to what the promises that were made, the lies that were told by Tony Abbott before the last election.”

23) Pausing indexation of Local Government Financial Assistance Grants for three years ($1.32 billion)

Source: Julie Collins, Speech to the Local Government Association, 17 June 2014 – “‘I am extremely disappointed the Abbott Government decided to freeze the indexation of the Financial Assistance Grants … The Abbott Government decision to freeze the indexation of the Financial Assistance Grants is a clear demonstration of the Government’s wrong priorities … I know many of you are speaking out against this decision and will so over the next few days, and I encourage you to continue”

24) Efficiencies resulting from the rationalisation of Indigenous programmes, grants and activities ($315 million)

Source: Bill Shorten, Media release, 14 May 2014 – “Tony Abbott’s claim to be a ‘Prime Minister for Indigenous Affairs’ has been exposed as a hollow platitude. His budget of broken promises has gutted more than $500 million from programs that support Aboriginal and Torres Strait Islander peoples. No true Prime Minister for Indigenous Affairs would be so heartless about one of the most important policy challenges facing our Parliament.”

25) Changes to Industry Skills Programmes ($271 million)

Source: Sharon Bird, Hansard, 1 October 2014 - "Finally, the report indicated that we needed to get seriously into the business of guaranteeing a supply of capable apprentices. They recommended that many of the programs that were sadly axed in the budget, such as Australian Apprenticeships Mentoring Program, the Australian Apprenticeships Access Program, the Accelerated Australian Apprenticeships Program and Apprenticeship to Business Owner were important to that task."

26) Changes to Industry Support programmes ($502 million)

Source: Kim Carr, Senate Hansard, 17 November 2014 - "The unending cycle of reviews does not do anything other than add to the uncertainty and the government's cover, when in reality there is an unmitigated hostility: the destruction of Commercialisation Australia, of Enterprise Connect, of the Innovation Investment Fund and of the Australian Industry Participation Plan, and the attempts to destroy the TCF support program—the list goes on and on and on."

27) Reducing Landcare uncommitted funding for future grant rounds ($644 million)

Source: Joel Fitzgibbon, House Hansard, 15 May 2014 – “One of the less-publicised details was the $480 million cut to Landcare. This cut is a very bad mistake … This ill-conceived budget decision is a bad mistake and, for the sake of our farmers, our economy and the environment, it should be reversed.”

28) Replacing Tools For Your Trade with Trade Support Loans ($560 million)

Source: Sharon Bird, Media Release, 14 November 2014 - "Instead of investing in jobs for the future and skilling up our existing workforce, the Abbott Government has ripped almost $2 billion from the skills portfolio by axing the... Tools for Your Trade Program"

29) ABC funding changes ($277 million)

Source: Bill Shorten, Doorstop, 25 November 2014 - “I can certainly give the commitment that under Labor, we will increase the funding of the ABC.”

30) Savings from research funding (CSIRO, ANSTO and Australian Institute of Marine Science) ($76 million)

Source: Chris Bowen, ABC AM, 26 November 2014 - "Now when you look at what they're doing in totally in research and development, whether it's the $113 million cut to the CSIRO, whether it's the abolition of many commercialisation and innovation organisations - effectively the halving of innovation and commercialisation funding when it goes to the allocation of those organisations - they're fundamentally bad changes, dumb changes."

31) Reducing uncommitted funding for arts programmes ($108 million)

Source: Mark Dreyfus, Media release, 14 May 2014 – “The worst fears of the arts community have been confirmed in last night’s Budget, as more than $100 million has been slashed from the Arts budget... These funding cuts will have a devastating impact on all arts and cultural activities right across Australia... Labor believes the arts are a vital part of Australia as a nation, and are worthy of government support.”

32) Terminating the Australia Network contract with the ABC ($99 million)

Source: Plibersek/Clare, Media Release, 14 May 2014 - “Tony Abbott’s $200 million Budget cut to the ABC’s Australia Network is a clear broken promise. The ABC was funded to run the Australia Network…The Australia Network is a vital public diplomacy tool that reaches up to 167 million households, giving Asia and the world an insight into Australian life and values. Yesterday, Tony Abbott ripped the ABC contract to shreds and abolished the network.”

33) Increased efficiencies in the AFP and ceasing additional recruitment at the end of 2014-15 ($62 million)

Source: David Feeney, Media release, 14 May 2014 – “The Abbott Government has unleashed a Budget of twisted priorities with $11.7 million aced from the Australian Federal Police... To make matters worse, the Abbott Government has cancelled $42.5 million of funding allocated by the former Labor Government for additional sworn officers. The Abbott government’s Budget of broken promises will compromise Australia’s national security and capacity to tackle organised and transnational crime, high tech crime, drug trafficking, major fraud, money laundering and terrorism.”

34) Opposition to Social Security Assets Test — re-balance asset test thresholds and taper rate ($3.55 billion)

Source: Shorten and Macklin Press Conference, 16 June 2015 – “We’re here today to talk about Labor’s determination to defend pensioners against Mr Abbott and the changes he’s proposing and the cuts he’s inflicting... The Liberal Party has proposed that 330,000 pensions either lose all or part of their pension. But furthermore, the changes which Mr Abbott’s proposing to the pension will mean that another 700,000 people now working in their 50s and early 60s will face cuts to their pension. The Liberals are coming after your pension and the only thing standing between pensioners having significant cuts to their pension and Mr Abbott, is the Labor Party.”

35) Reinstating the Schoolkids Bonus ($4.48 billion)

Source: Macklin Media Release 1 March 2016 – “In the last two Budgets, the Liberals have proposed... Axing the Schoolkids Bonus... Labor will stand with Australian families against these cuts every day up to the next election.”

Labor’s spending proposals (2016-17 to 2019-20) - $11.79 billion

36) Waive HECS debts for 100,000 Science Technology Engineering and Maths Uni students (estimated at $696 million)

Source: Bill Shorten, Budget Reply, 14 May 2015 – “we will write off the HECS debt of 100,000 science technology, engineering and maths students.”

37) New "Smart Investment" fund to back great Australian ideas ($500 million)

Source: Bill Shorten, Budget Reply, 14 May 2015 – “Labor will create a new, $500 million, Smart Investment Fund, to back-in great Australian ideas.”

38) Boost the skills of 25,000 current primary and secondary teachers ($127 million)

Source: Bill Shorten, Budget Reply, 14 May 2015 – “Labor will boost the skills of 25,000 current primary and secondary teachers.”

39) Train an additional 25,000 new teachers who are science and technology graduates ($133 million)

Source: Bill Shorten, Budget Reply, 14 May 2015 – “We will train 25,000 new teachers who are science and technology graduates.”

40) Treasury office set up in Perth CBD with 15 staff ($1.4 million)

Source: West Australian Article, 16 July 2015 – “Shadow Treasurer Chris Bowen will today commit to setting up a Perth CBD office of Treasury with 15 staff including some recruited directly from WA.”

41) Doubling of the Humanitarian intake ($238 million)

Source: The Australian Article, 27 July 2015 – “Labor will match the Abbott government’s increase in the humanitarian intake from the current 13,750 places to 18,750 by 2018. ‘We will be matching them during that period in terms of the increase and then we will continue increasing it from that period through until 2025 to take it to 27,000,’ Mr Marles said.”

42) Additional UNHCR funding ($450 million)

Source: The Australian Article, 27 July 2015 – “Labor now goes to the election with a suite of measures that includes...dedicating $450 million over the forward estimates to the UN High Commissioner for Refugees”

43) Reinstating the Automotive Transformation Scheme ($971 million). Note Labor has said they would continue the ATS at current funding levels ($300 million per year) until 2021 and would widen the qualifications in order to prevent under-spends. This figure is based on the difference between the total amounts per year and the projected spends in the 2015-16 Budget.

Source: Senate Economics References Committee, Inquiry into the Future of Australia’s Automotive Industry, Interim Report, Chapter 3, 3.33, 19 August 2015 – “At a minimum, the committee considers the current level of ATS funding needs to be maintained through to 2021 as provided for in the ATS Act. IN addition, current under-spends in the ATS should be rephrased from stage 1 to stage 2.”

44) Domestic Violence/Women funding ($72 million)

Source: http://www.alp.org.au/familyviolence - “Labor’s interim package will deliver more than $70 million over three years in targeted funding to ensure those suffering from family violence can access critical service.”

45) Labor’s fairer plan for universities ($2.5 billion)

This is the net cost over the forward estimates (estimated by the PBO) of introducing a Student Funding Guarantee, providing $31 million in funding for Tertiary Education Quality Standards Australia, and establishing an independent Higher Education Productivity and Performance Commission. Labor has indicated that this $2.5 billion net cost includes the impact of not proceeding with the following measures announced by the Government:

- Expansion of the demand-driven system to sub-bachelor places and to bachelor places at non-university higher education providers;

- Abolishing FEE–HELP and VET FEE–HELP loan fees; and

- Establishment of the Structural Adjustment Fund promised to help regional universities adjust to a deregulated system.

Source: http://www.nodebtsentence.org/laborsfairerplan - “... Labor has a fairer plan for our universities... The net impact of Labor’s package, costed by the Parliamentary Budget Office, is $2.5 billion over the budget forward estimates.”

46) Extra funding to Australian NGOs in developing countries ($160 million)

Source: Tanya Plibersek media release 16 October 2015 – “Labor commits an extra $40 million a year to help some of the world’s poorest people.”

47) New Townsville Stadium ($100 million)

Source: Shorten, Chalmers, Collins and O’Toole media release 4 November 2015 – “A Shorten Labor Government will provide $100 million to build a new Townsville Stadium in partnership with the Queensland Labor Government.”

48) Extra funding of $2 million a year to peak disability advocacy organisations ($4 million)

Source: http://www.alp.org.au/disabilityadvocacyplan - “Labor will provide an additional $2 million a year to peak disability advocacy organisations.”

49) Labor schools funding – ($5.45 billion)

Source: Shorten and Ellis media release 28 January 2016 – “Labor’s Your Child. Our Future plan will see an additional investment in our education system of $4.5 billion over school years 2018 ad 2019 an d a total provision of $37.3.billion for the package over the decade.”

50) Committing an additional $9 million on Aboriginal vision loss ($9 million)

Source: Shorten Close the Gap Speech , 10 February 2016 - "So, today, I am pleased to announce that a Labor Government will commit an additional $9 million to close the gap in Aboriginal and Torres Strait Islander vision loss."

51) Funding for Australasian Society of Clinical Immunology and Allergy and Anaphylaxis Australia for managing allergic diseases ($1 million)

Source: Catherine King Media Release, 29 April 2016 – “A Shorten Labor Government will commit $1.1 million to better manage allergic diseases and their associated health risks.”

52) Royal Commission into the Banking and Financial Services Sector ($53 million)

Source: Shorten, Bowen, Dreyfuss and Chalmers Media Release, 8 April, 2016 – “The proposal for a Royal Commission into Australia’s Financial Services Industry has been costed by the independent Parliamentary Budget Office at $53 million over two years.”

53) Additional funding for Students with a Disability ($320 million)

Source: Macklin and Ellis Media Release, 13 April 2016 – “Labor will more than reverse the Turnbull Government’s cuts to the More Support for Students with Disability program – investing a further $320 million in children with disability.”

Labor’s proposals to increase taxes - $12.09 billion (estimated over 2016-17 to 2019-20)

54) Labor's multinational tax proposal (estimated at $1.65 billion)

Treasury analysis of Labor’ thin capitalisation policy that says it is un-quantifiable, but we note they have said their thin cap policy raises $1.65 billion over the forwards out of a total of $1.9 billion, and so extending that on a pro-rata basis would raise $6.26 billion over 10 years (since the total multinational package raises $7.2 billion over that period). Labor’s announced policy includes four elements, including thin capitalisation reduced to 30% - this is the only element included in these numbers; Hybrid rules - redundant as it is included in the 16-17 Budget; Increased ATO compliance - redundant as it is included in the 16-17 Budget; 3rd party data matching - redundant as the policy was to bring forward this measure to start on 1 July 2015 instead of 1 July 2016, which has now passed. Shorten, Bowen and Leigh media release 13 April 2015

55) Negative Gearing and CGT (estimated at $1.39 billion)

Source: Shorten, Bowen and Gallagher Release, 13 February 2016

56) Continue Deficit Levy ($4.2 billion)

Source: Chris Bowen interview on Seven News, 3 May 2016

57) Hold the small business tax rate at 27.5 per cent and reduce the turnover threshold to $2 million (estimated at $4.85 billion)

Source: Chris Bowen interview on Nine News, 3 May 2016

Labor’s Climate Change Action Plan – Labor are yet to release costings

Source: Shorten and Butler Media Release, 27 April 2016

Labor’s continued increase in tobacco excise (would no longer raise any additional revenue based on 2016-17 Budget measures)

Source: http://www.alp.org.au/bestpracticetobaccopolicy

Labor's Superannuation Policy (would no longer raise any additional revenue based on 2016-17 Budget measures)

Source: ALP Fact Sheet issued by Shorten office 22 April 2015

Labor’s savings proposals – $1.86 billion

58) Not increasing the rate of FTB-B by $1000 for Children under one years - $497 million

Source: Shorten, Bowen and Macklin media release 10 November 2015

59) Not increasing FTB-A, Youth Allowance and DSP Child allowances for under 18s living at home by $10 per fortnight - $1.20 billion

Source: Shorten, Bowen and Macklin media release 10 November 2015

60) Not conduct a plebiscite on gay marriage - $158 million

Source: Tony Burke interview with Greg Jennett on ABC News 24 on 2 February 2016

Not proceeding with the Emissions Reduction Fund – would not constitute a save as all money has already been committed.

Source: The Australian – August 14 2015

Karen Wu - 0428 350 139