Show Us the Money Bill - Labor’s $52 Billion Budget Black Hole

JOINT MEDIA RELEASE

Senator the Hon. Mathias Cormann

Minister for Finance

The Hon. Josh Frydenberg MP

Assistant Treasurer

Tonight Bill Shorten has to demonstrate to the Australian people that he has what it takes to make the necessary decisions in the national interest – to strengthen growth, create more jobs and to get the Budget back into surplus.

He will have to show how he is going to pay for his new spending as well as for the savings he continues to oppose.

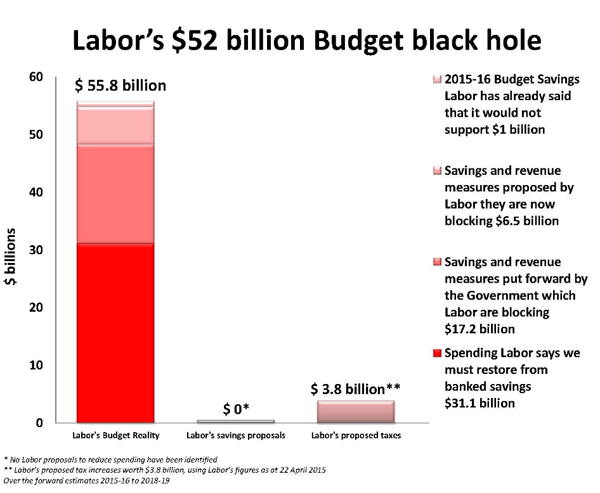

Because right now Labor has a Budget black hole of more than $52 billion.

Labor is:

- Blocking about $17 billion worth of Government savings and revenue measures in the Budget;

- Blocking savings and revenue measures they themselves initiated and banked in their last Budget now totalling $6.5 billion; and

- Calling for the restoration of more than $31 billion in spending from savings that the Government has already banked – including $18 billion in foreign aid.

Almost before the ink was dry on the 2015-16 Budget, Labor has already said they would oppose the saving of nearly $1 billion from making Parental Leave Pay arrangements fairer.

Tonight, Mr Shorten must outline how he will pay for Labor's $52 billion Budget black hole.

If he doesn't like our savings, what are his savings?

So far Bill Shorten has not identified a single proposal to reduce spending. His only proposals to improve the budget bottom line ever so slightly are to increase taxes, in particular on those Australians saving for their retirement.

In Mr Shorten's year of ideas he must announce Labor's alternative plan for Budget savings, not just re-announce old plans for new or increased taxes.

Labor's $52 billion Budget black hole

Savings and revenue measures proposed by Labor they are now blocking - $6.5 billion (2015-16 to 2018-19)

1) Change of Labor's Student Start Up Scholarships (provided as a grant) to a loan repayable through HECS ($2.1 billion)

2) Applying an efficiency dividend to university funding ($1.2 billion)

3) Ending the discount for paying HECS fees upfront ($336 million)

4) Cancellation of the 2015-16 Tax Cuts linked to the carbon tax ($2.8 billion)

Savings put forward by Government which Labor are blocking - $17.2 billion (2015-16 to 2018-19)

5) Maintaining the payment rates for Family Tax Benefits ($3.0 billion)

6) Limiting Family Tax Benefit Part B to families with children under six years old ($3.5 billion)

7) Changes to Family Tax Benefit End of Year Supplements ($1.7 billion)

8) Ceasing the Seniors Supplement to Commonwealth Seniors Health Card Holders ($1.1 billion)

9) Switching under 25s from Newstart to Youth Allowance ($504 million)

10) Ceasing the Pensioner Education Supplement ($315 million)

11) One week waiting period for working age payments ($255 million)

12) Ceasing the Education Entry Payment ($76 million)

13) Commencement of Veterans Disability Payments from date of claim ($40 million)

14) Revised Higher Education Reforms ($1.3 billion)

15) Fuel Excise Indexation ($3.3 billion)

16) Increased co-payments for subsidised pharmaceuticals ($1.5 billion)

17) Maintain eligibility thresholds for Australian Government payments for three years (Child Care Benefit Component) ($50 million)

18) Abolishing ARENA ($567 million)

Spending Labor says we must restore from banked savings - $31.1 billion (2015-16 to 2018-19)

19) Restoration of Labor's preferred timetable to increase superannuation guarantee rate to 12 per cent ($4.5 billion)

Source: Shorten, interview with Patricia Karvelas: RN Drive ABC Radio: 18 March 2015

20) Shadow Minister for Foreign Affairs and International Development has committed Labor to spend an extra $18 billion on foreign aid (overturning the Government's decisions in the 2014-15 Budget Budget and 2014-15 MYEFO)

Source: Tanya Plibersek, 30 April 2014

21) Ceasing the funding guarantees under the National Health Reform Agreement 2011 and revising Public Hospital funding arrangements from 1 July 2017 ($2.7 billion)

Source: Chris Bowen, Sky, 26 November 2014

22) Terminating the National Partnership on Certain Concessions for Pensioners and Seniors Card Holders ($1.3 billion)

Source: Bill Shorten, Doorstop, 4 June 2014

23) Pausing indexation of Local Government Financial Assistance Grants for three years ($1.2 billion)

Source: Julie Collins, Speech to the Local Government Association, 17 June 2014

24) Efficiencies resulting from the rationalisation of Indigenous programmes, grants and activities ($392 million)

Source: Bill Shorten, Media release, 14 May 2014

25) Changes to Industry Skills Programmes ($317 million)

Source: Sharon Bird, Hansard, 1 October 2014

26) Changes to Industry Support programmes ($516 million)

Source: Kim Carr, Senate Hansard, 17 November 2014

27) Reducing Landcare uncommitted funding for future grant rounds ($594 million)

Source: Joel Fitzgibbon, House Hansard, 15 May 2014

28) Replacing Tools For Your Trade with Trade Support Loans ($606 million)

Source: Sharon Bird, Media Release, 14 November 2014

29) ABC funding changes ($244 million)

Source: Bill Shorten, Doorstop, 25 November 2014

30) Savings from research funding (CSIRO, ANSTO and Australian Institute of Marine Science) ($112 million)

Source: Chris Bowen, ABC AM, 26 November 2014

31) Australian Tax Office (ATO) savings ($143 million)

Source: Andrew Leigh, Media Release, 17 November 2014

32) Australian Securities and Investment Commission (ASIC) savings ($129 million)

Source: Andrew Leigh, Media release, 4 June 2014

33) Reducing uncommitted funding for arts programmes ($96 million)

Source: Mark Dreyfus, Media release, 14 May 2014

34) Terminating the Australia Network contract with the ABC ($89 million)

Source: Plibersek/Clare, Media Release, 14 May 2014

35) Increased efficiencies in the AFP and ceasing additional recruitment at the end of 2014-15 ($61 million)

Source: David Feeney, Media release, 14 May 2014

36) SBS funding changes ($51 million)

Source: Bill Shorten Email to Labor Members, 25 November 2014

Labor's proposals to increase taxes - $3.8 billion (estimated over 2015-16 to 2018-19)

37) Labor's Superannuation Policy - Reduce concessions by 15% for earnings $75,000 annual threshold (estimated at $1.4 billion from Labor's press release on 22 April 2015)

38) Labor's Superannuation Policy - Reduce the higher income superannuation charge from $300,000 to $250,000 (estimated at $500 million from Labor's press release on 22 April 2015)

39) Labor's multinational tax proposal (estimated at $1.9 billion from Labor's press release on 13 April 2015)

For Minister Cormann - Karen Wu - 0428 350 139

For the Assistant Treasurer - Matt Francis - 0467 777 220